Deferred: Revolutionizing 1031 Exchanges

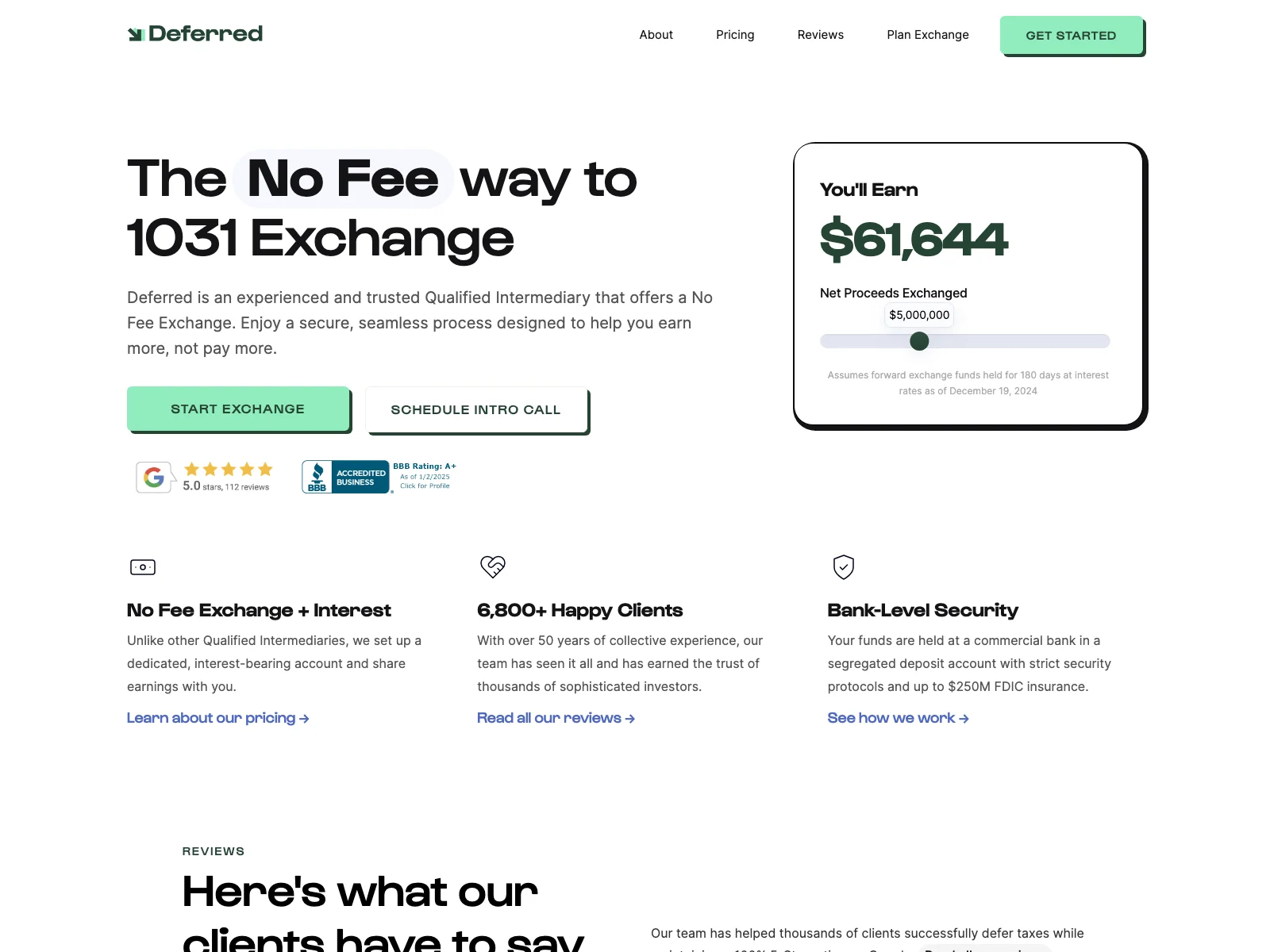

Deferred is not your typical 1031 exchange service. It stands out by offering a no-fee exchange and sharing the interest earned on users' funds. This is a game-changer in the industry.

The core features of Deferred are impressive. It sets up a dedicated, interest-bearing account and shares the earnings with clients. This not only saves them money but also provides an additional source of income. The security measures are top-notch, with funds held in segregated accounts at a commercial bank, up to $250M FDIC insurance, advanced fraud prevention, and bank-level data encryption.

Using Deferred is straightforward. Clients can get started online and benefit from a seamless process. The company's staff, with attorney and CPA expertise and 40+ years of experience, ensures that exchanges are handled correctly every time.

In comparison to other qualified intermediaries, Deferred offers a superior experience. It exposes the hidden costs and unfair practices of the industry and provides a transparent and beneficial alternative. With over 50 years of collective experience and 6,800+ happy clients, Deferred has proven its worth.

In conclusion, Deferred is redefining the 1031 exchange process, making it more accessible, secure, and profitable for investors.