FinFloh: Revolutionizing Accounts Receivable Management

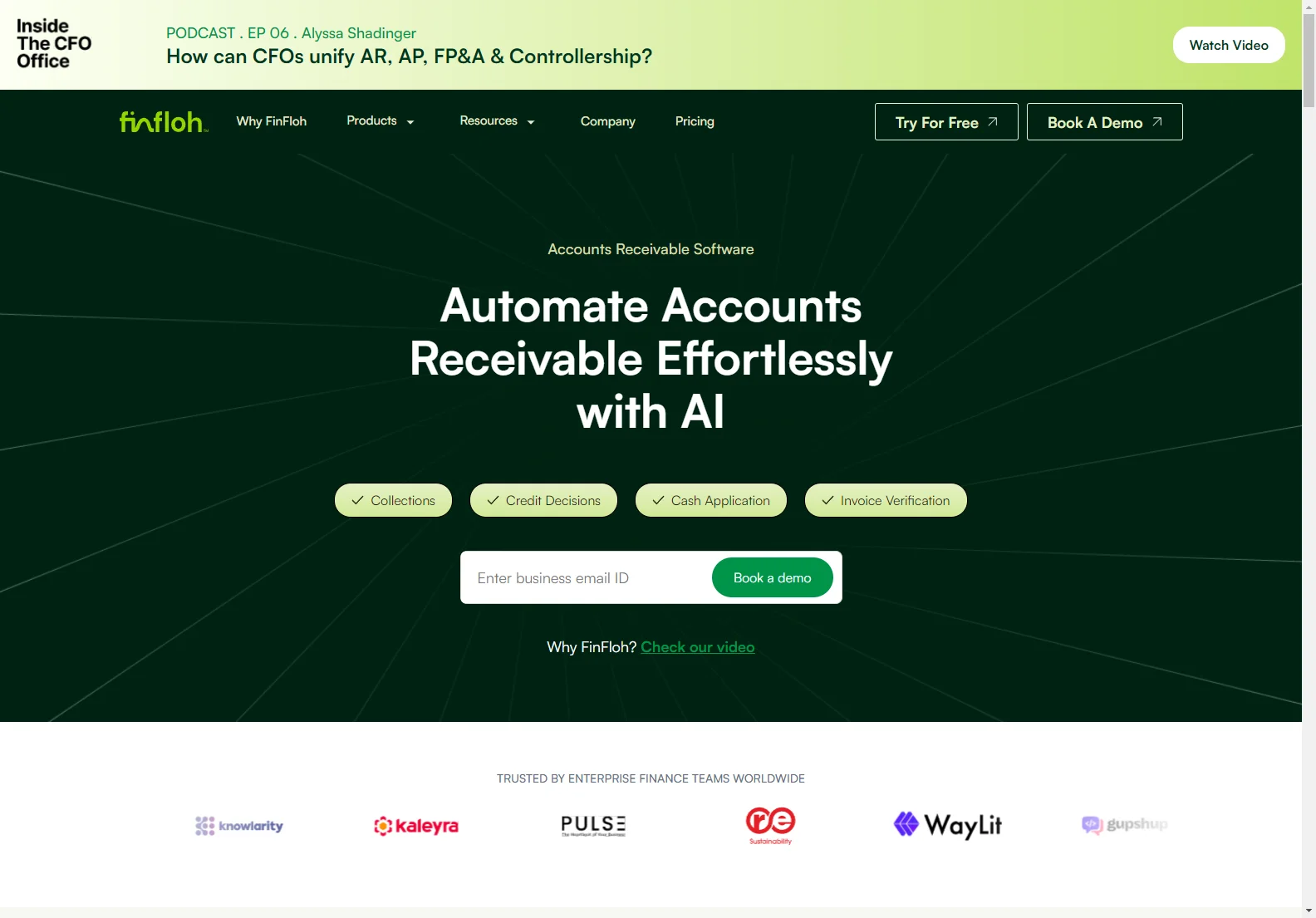

FinFloh is not just an accounts receivable software; it's a game-changer for B2B finance teams. It offers a comprehensive solution to transform the accounts receivable process.

The core features of FinFloh are truly remarkable. Its AI-powered collections system creates a worklist for maximum efficiency, assigning workflows based on risk, amount, and priority. The credit scoring and decisioning capabilities use ML and market/historical data to enhance credit reviews. Dispute resolution is made easier with predictive AI for advanced intelligence and diagnosis.

In terms of basic usage, FinFloh is user-friendly. It integrates seamlessly with ERP/CRM and other systems, allowing for auto-fetching of invoices and resolving billing ID and cancellation issues. The software also handles invoice verification, delivery, and audit.

Compared to other accounts receivable solutions, FinFloh stands out with its ability to reduce DSO by 40%, save 250 man-hours per month, and decrease high-aging balances by 50%. It provides a best-in-class experience for CFOs and B2B finance teams.

In conclusion, FinFloh is the ultimate accounts receivable solution, combining automation and AI to streamline the invoice-to-cash process and drive business success.