Salient: Revolutionizing Loan Servicing with AI

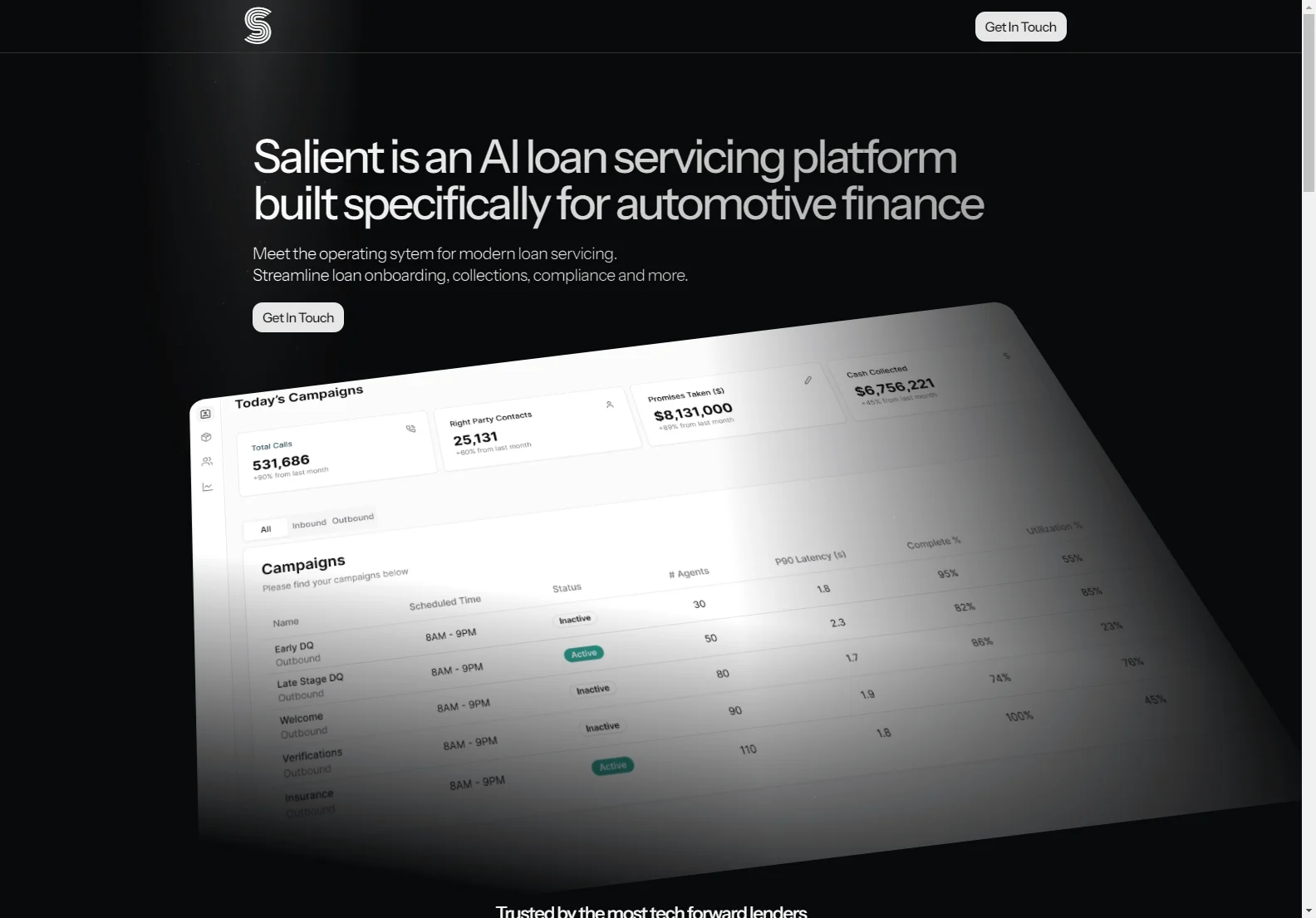

Salient is an innovative AI loan servicing platform specifically designed for the automotive finance sector. It serves as the operating system for modern loan servicing, offering a comprehensive solution to streamline various aspects of the lending process.

The core features of Salient are truly remarkable. Its AI Agents are a game-changer, capable of interacting with consumers through multiple channels such as voice, text, email, and web chat. This enables real-time collection of payments, processing of due date changes and extensions, management of payoffs, and update of insurance information. The platform is also tailored to the automotive lending industry, with a relentless focus on streamlining operations and surfacing high-quality data at all points. Additionally, Salient is committed to optimizing the consumer experience, setting it apart from other solutions in the market.

In terms of basic usage, Salient integrates seamlessly with existing contact center, payment processor, and LMS systems. It can integrate with any API-driven payment processor, including popular options like Stripe, ACI, PayNearMe, and Nowpay. It also retrieves and pushes borrower updates in real time to the existing LMS, regardless of the system being used. Moreover, Salient allows for smooth call management within the existing CCaaS platform.

When compared to existing AI products, Salient stands out with its specialized focus on the automotive finance industry. It offers a unique combination of features and capabilities that are specifically designed to meet the needs of this sector. For example, its AI Agents' multi-channel interaction capabilities provide a more comprehensive and efficient customer service experience.

In conclusion, Salient is a powerful tool that is transforming the way loan servicing is done in the automotive finance industry. Its innovative features, seamless integration capabilities, and focus on the consumer experience make it a valuable solution for lenders looking to stay ahead in the digital age.