WorkFusion AI Digital Workers for AML Risk Mitigation

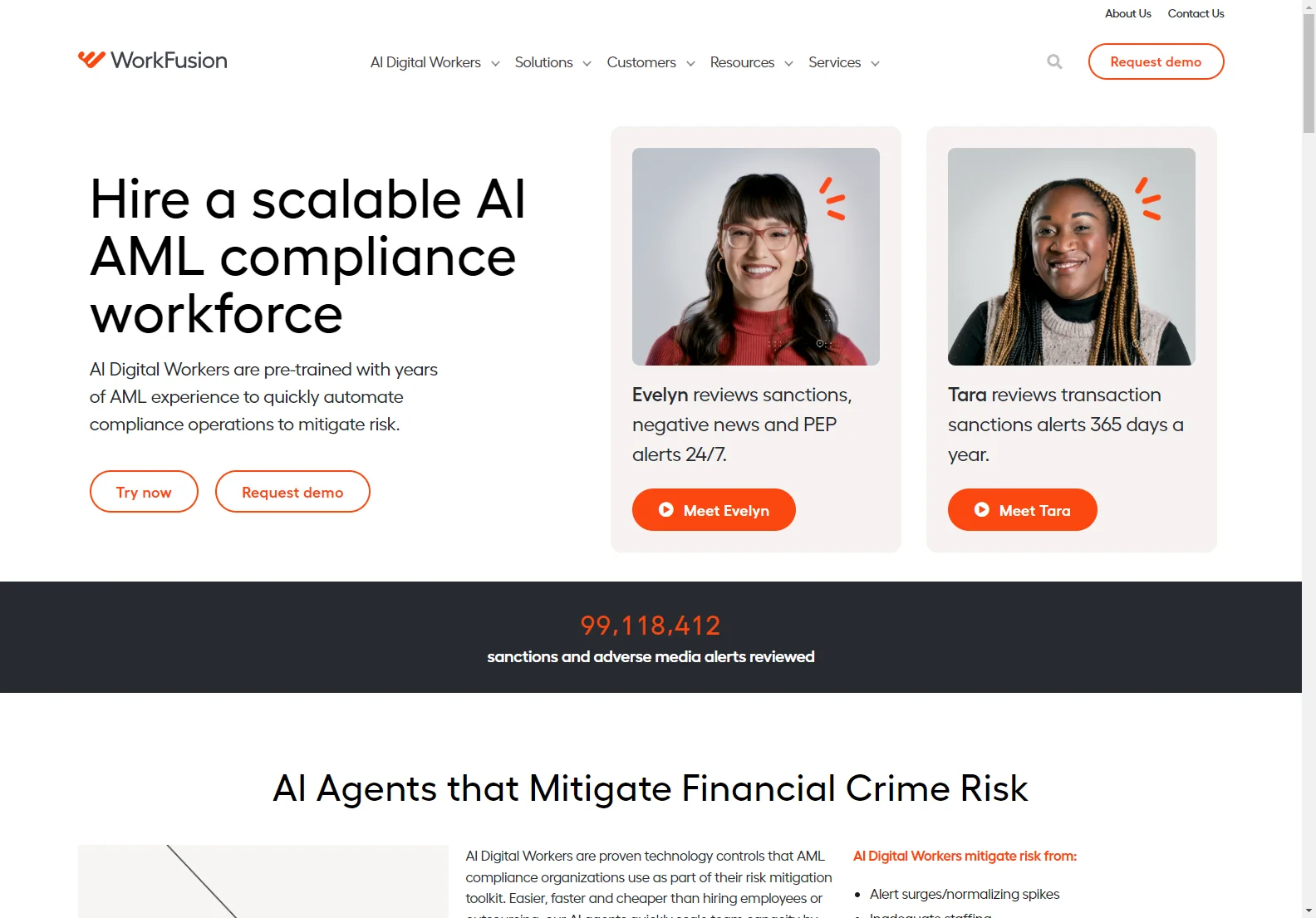

WorkFusion's AI Digital Workers offer a revolutionary approach to handling Anti-Money Laundering (AML) compliance. These digital workers are pre-trained with years of AML experience, enabling them to quickly automate compliance operations and effectively mitigate risks.

Overview

The financial crime compliance landscape is fraught with challenges. Complex regulations, increased sanctions, and staffing difficulties have made it more crucial than ever to have efficient solutions. WorkFusion's AI Digital Workers step in as a proven technology control. They are not only easier, faster, and cheaper than hiring employees or outsourcing but also provide consistent and accurate alert adjudications, improving compliance with detailed narratives for regulators.

Compared to traditional operating models, these AI Digital Workers are 10x more effective. They can quickly scale team capacity by fulfilling complete level 1 AML analyst job roles in various functions such as sanctions screening alert review, adverse media monitoring, and transaction monitoring investigations.

Core Features

- Pre-trained Expertise: With years of AML experience baked in, they are like hiring an employee with five years of experience right out of the box. They can handle tasks such as reviewing sanctions, negative news, and PEP alerts around the clock.

- Scalability: Dynamically scale to meet your organization's growth targets and increasing alert volumes without sacrificing on quality. This allows for seamless adaptation to the ever-changing demands of AML compliance.

- Explainable AI: Aligned with MRM to explain how the AI derives its decisions, providing transparency and trust in the automated processes.

- Enhanced with GenAI: Accelerates automation rates up to 95% STP, reduces error rates, and goes beyond current template-based narratives, enhancing overall efficiency.

Basic Usage

Integrating these AI Digital Workers into your AML compliance team is straightforward. They can assist with various aspects such as sanctions screening, adhering to BSA/OFAC requirements while automatically scaling up capabilities. In adverse media monitoring, they streamline investigations of negative news, reducing the risk of regulatory penalties.

For transaction screening, they adjudicate false-positive sanctions alerts in near real-time, keeping transactions risk-free. And in customer service, they resolve customer inquiries promptly with high service standards.

In conclusion, WorkFusion's AI Digital Workers are a powerful tool in the fight against financial crime, offering a comprehensive solution to AML compliance challenges.