Write better risks, faster with Artificial

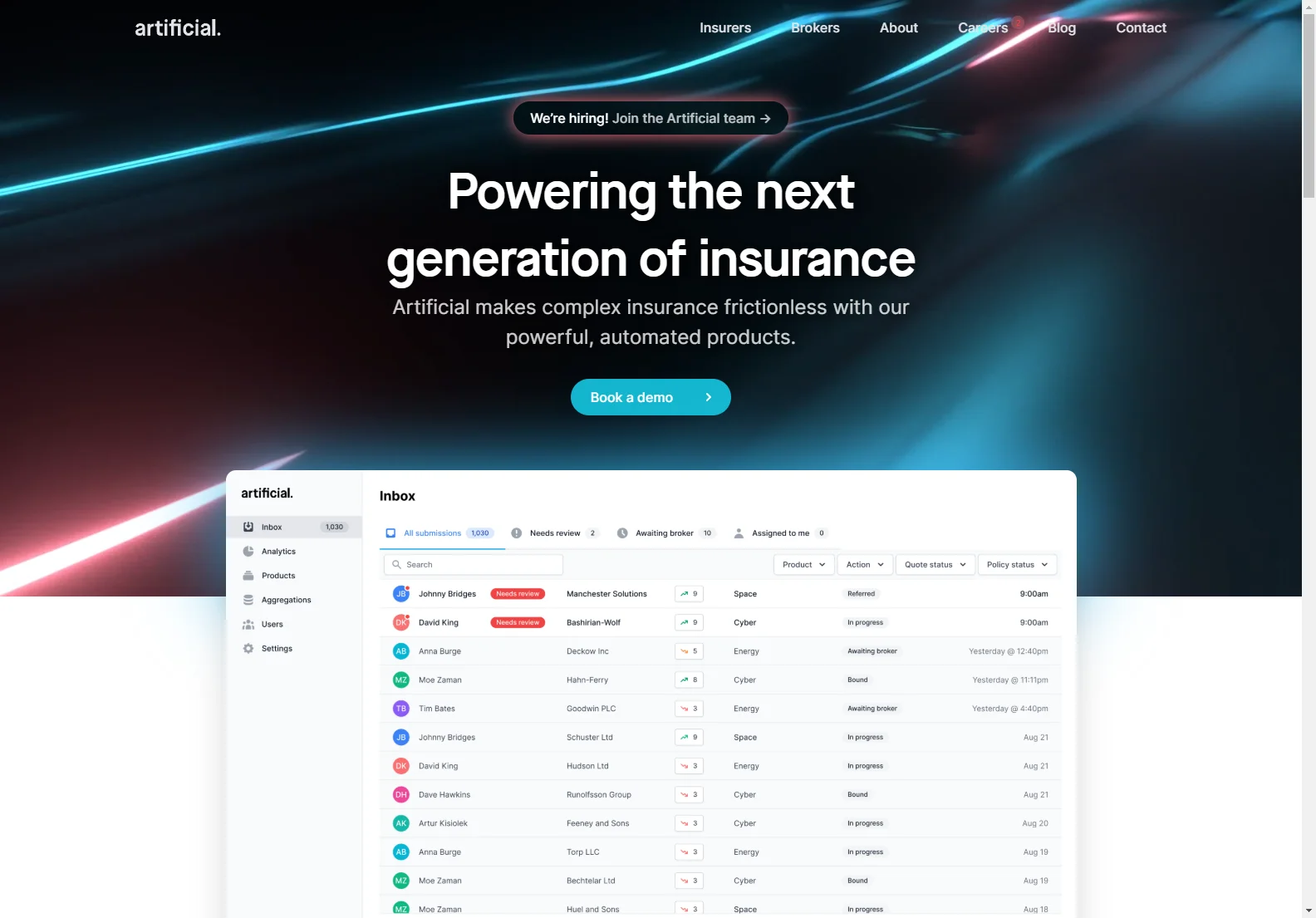

Artificial is revolutionizing the insurance industry with its powerful AI capabilities. It aims to make complex insurance processes frictionless, allowing businesses to thrive.

Overview

Artificial offers a suite of next-generation insurance products. It's trusted by some of the world's best insurance companies, which speaks volumes about its reliability and effectiveness. For instance, it helps insurers write more business by enabling underwriting up to 8x faster, freeing up valuable time for high-value tasks.

Core Features

- Underwriting Platform: This gives insurers the power to harness their data effectively, enabling them to write better risks at a much faster pace. It's like having a supercharged engine for the underwriting process, streamlining it and making it more accurate.

- Contract Builder: Say goodbye to the days of complex data entry. With Artificial's Contract Builder, insurers can create flexible, digital, and compliant contracts with ease. It's a game-changer in contract documentation, as seen in the successful implementation at BMS Group where it transformed the production of contract docs and helped meet the demands of the digital era in the London market.

Basic Usage

To get started with Artificial, one can simply book a demo. This allows businesses to see firsthand how it can take their insurance portfolios further and faster. By leveraging Artificial's capabilities, companies can enhance their performance by improving risk selection and reducing loss ratios with more accurate data. They can also significantly cut costs, like reducing the cost of processing complex submissions by 90%.

In comparison to other existing AI solutions in the insurance space, Artificial stands out with its comprehensive suite of products specifically tailored to the insurance industry's unique needs. It's not just a one-trick pony but a holistic solution that addresses multiple pain points, from underwriting to contract creation.