Addy AI: Revolutionizing Mortgage Lending with AI Technology

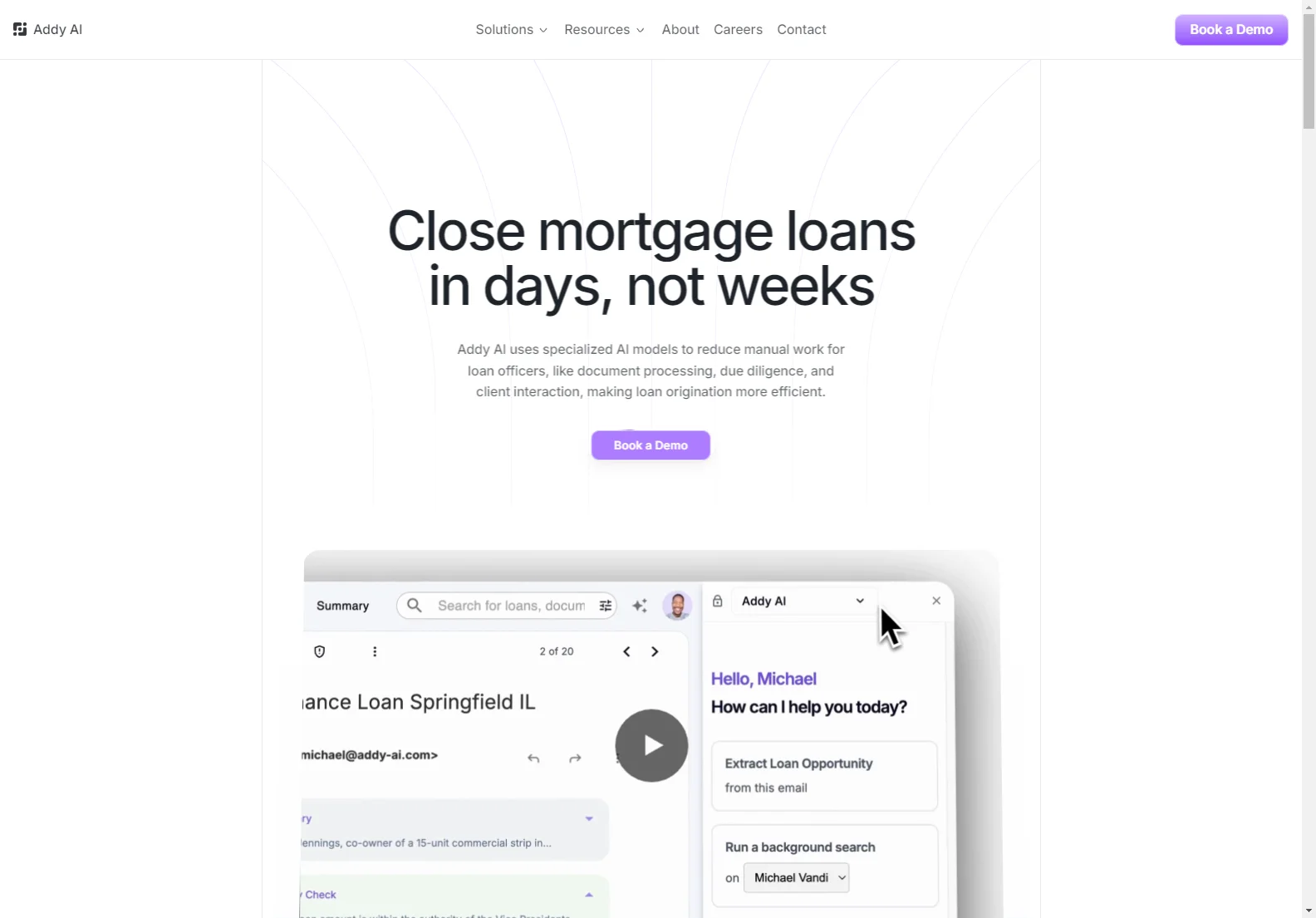

Addy AI is a game-changer in the mortgage lending industry. It utilizes specialized AI models to streamline and optimize various aspects of the lending process.

Overview

Addy AI is designed to make loan origination more efficient. It reduces the manual work for loan officers by automating tasks such as document processing, due diligence, and client interaction. This not only saves time but also increases the accuracy and speed of the lending process.

Core Features

One of the key features of Addy AI is its ability to instantly check loans to ensure they meet the credit policy. If a borrower is found to be ineligible, the tool offers suggestions to make them eligible. It also enables the extraction of all relevant loan data needed for review in seconds, saving valuable time and effort.

Another notable feature is the seamless integration with the CRM. This allows for automatic sync and update of loan data, enhancing the workflow efficiency and reducing the potential for errors.

Addy AI also offers the ability to train specialized AI models to handle client follow-ups around the clock. This ensures a great experience for clients and helps lenders stay competitive in the market.

Basic Usage

Using Addy AI is straightforward. Loan officers can simply upload the necessary documents, and the tool takes care of the rest. It processes the documents using state-of-the-art computer vision technology to extract the relevant data. The tool also allows for natural language interaction with mortgage documents, making it easy to find the data needed.

In conclusion, Addy AI is a powerful tool that is transforming the mortgage lending industry. It offers a range of features that make the lending process more efficient, accurate, and client-friendly.