Kniru: Revolutionizing Personal Finance with AI

Kniru is not just another financial tool; it's a game-changer in the world of personal finance. With its AI-powered capabilities, Kniru provides users with hyper-personalized financial management right at their fingertips.

The core features of Kniru are truly remarkable. It offers a wide range of services, including investment advice, expense management, retirement advice, tax advice, and loan & credit management. These features are designed to meet the diverse needs of users and provide them with comprehensive financial guidance.

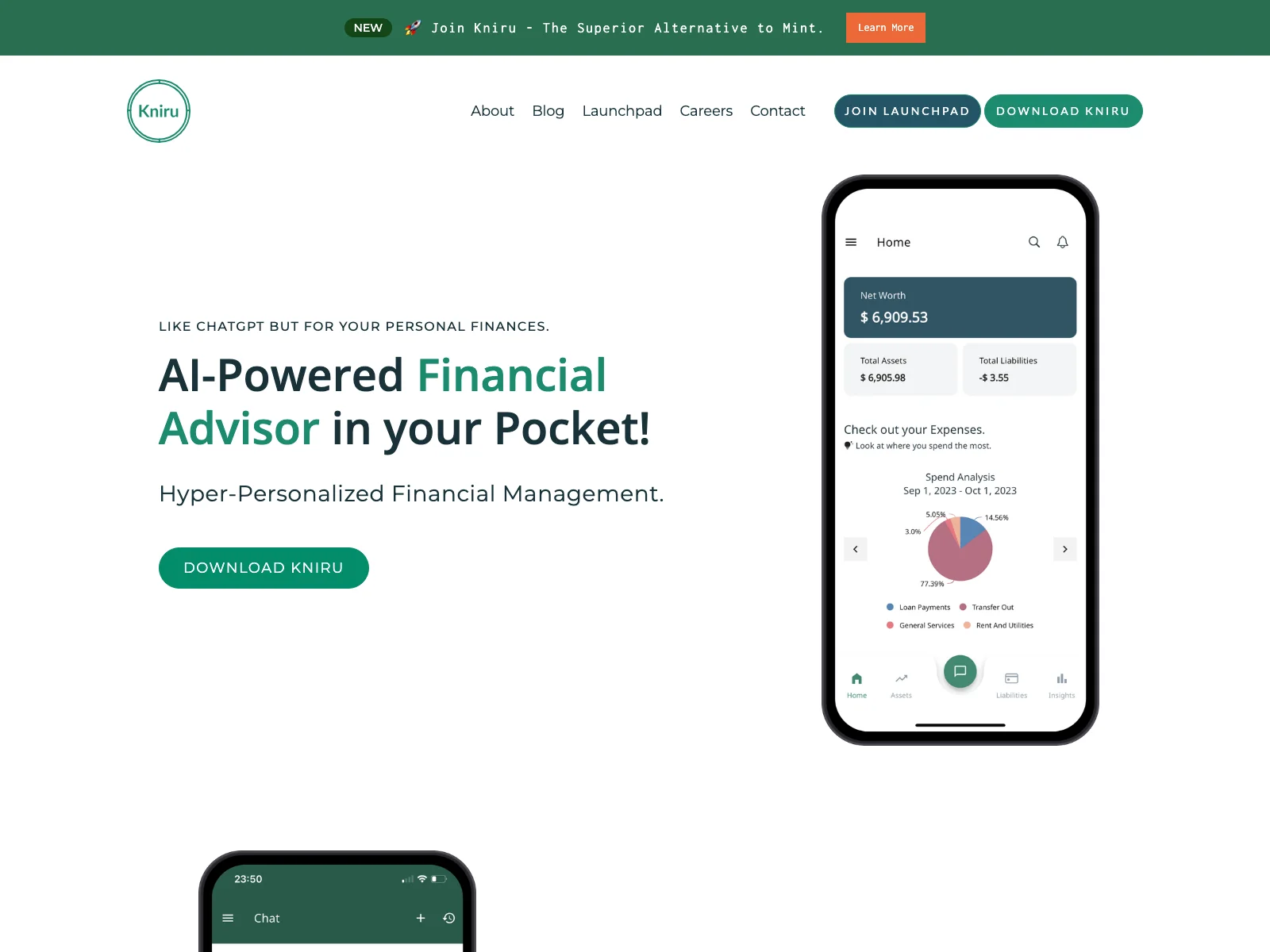

In terms of basic usage, Kniru is user-friendly and intuitive. Users can chat with Kniru to get answers to all their financial questions. The tool also provides precise, personalized, and actionable insights, helping users make informed decisions.

Another great aspect of Kniru is its state-of-the-art notifications. It offers personalized savings suggestions, bill reminders, budget alerts, anomaly detection, and portfolio alerts. These notifications keep users informed and on top of their finances.

Kniru also stands out for its fully automatic connections. It can seamlessly connect with global accounts, covering multiple countries. Whether you have accounts in the US, India, or other countries, Kniru has you covered.

The visibility provided by Kniru is like never before. It offers assets, liabilities, and insights dashboards, including detailed breakdowns of bank accounts, investments, real estate, loans, and credit cards. This level of transparency allows users to have a clear understanding of their financial situation.

In conclusion, Kniru is a powerful tool that combines advanced AI technology with practical financial management. It's a must-have for anyone looking to take control of their finances and make informed decisions.