finbots.ai: Revolutionizing Credit Risk Management

finbots.ai is a game-changer in the world of credit risk assessment. It offers a comprehensive solution that combines powerful AI and ML algorithms to provide lenders with accurate credit scoring.

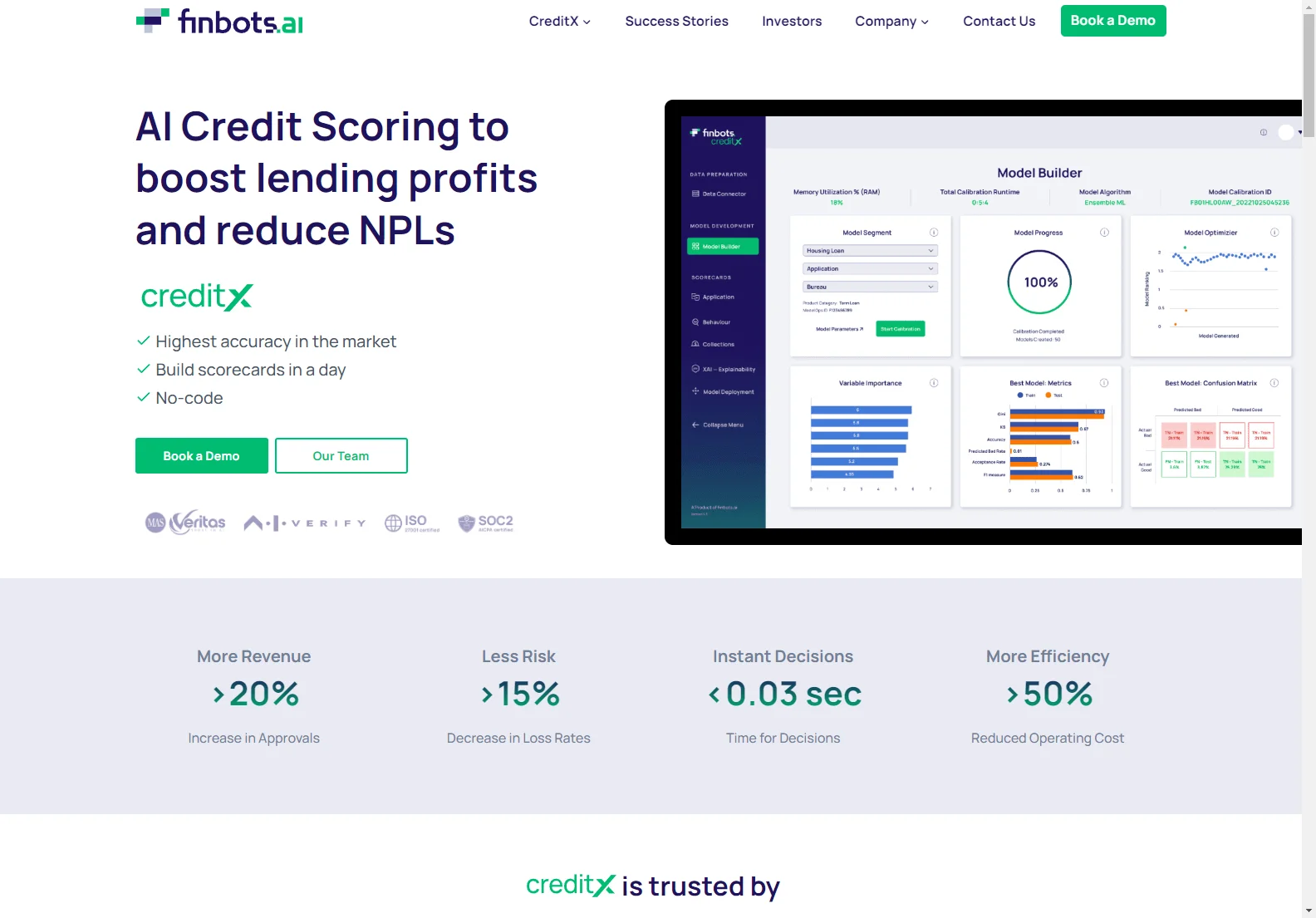

The platform's core features are truly remarkable. It enables the rapid and custom creation of scorecards, which can be built in a day. This is a significant advantage over other solutions that may take months to achieve the same result. The AI-automatically built scorecards are validated by regulators, ensuring compliance and reliability.

In addition to scorecard creation, finbots.ai also excels in data management. It allows for seamless connection of internal, external, and alternate data sources. The data ingestion, treatment, feature engineering, and variable selection processes are automated, making the entire workflow efficient and error-free.

The model builder and validation components of finbots.ai are designed to ensure the highest level of accuracy and explainability. This is crucial in the world of credit risk, where decisions need to be based on solid data and clear reasoning.

One of the key benefits of finbots.ai is its ability to increase lending approvals by over 20% while reducing loss rates by more than 15%. It also significantly enhances operational efficiency, reducing operating costs by over 50%. These results are achieved through instant decision-making, with decisions made in less than 0.03 seconds.

The platform is trusted by industry leaders and has been recognized for its compliance with regulatory requirements on data privacy, hosting, and security. It is among the first Fintech solutions globally to complete rigorous validation frameworks, ensuring its quality and performance.

finbots.ai's team is composed of experts in finance, AI, and technology. Their combined knowledge and expertise have led to the development of this innovative solution that is transforming the lending industry.

In conclusion, finbots.ai is not just a tool; it's a strategic partner for lenders looking to improve their credit risk management and drive business growth.